Installment Agreement

Understanding Streamlined Installment Agreements

If you owe the IRS back taxes, it might help to know that you’re not alone – and that you’re far from the first or…

Can You Have 2 Installment Agreements With the IRS?

The IRS reports that American taxpayers owed $114 billion in back taxes, penalties, and interest in 2020. Given such a high total, collecting tax debt becomes…

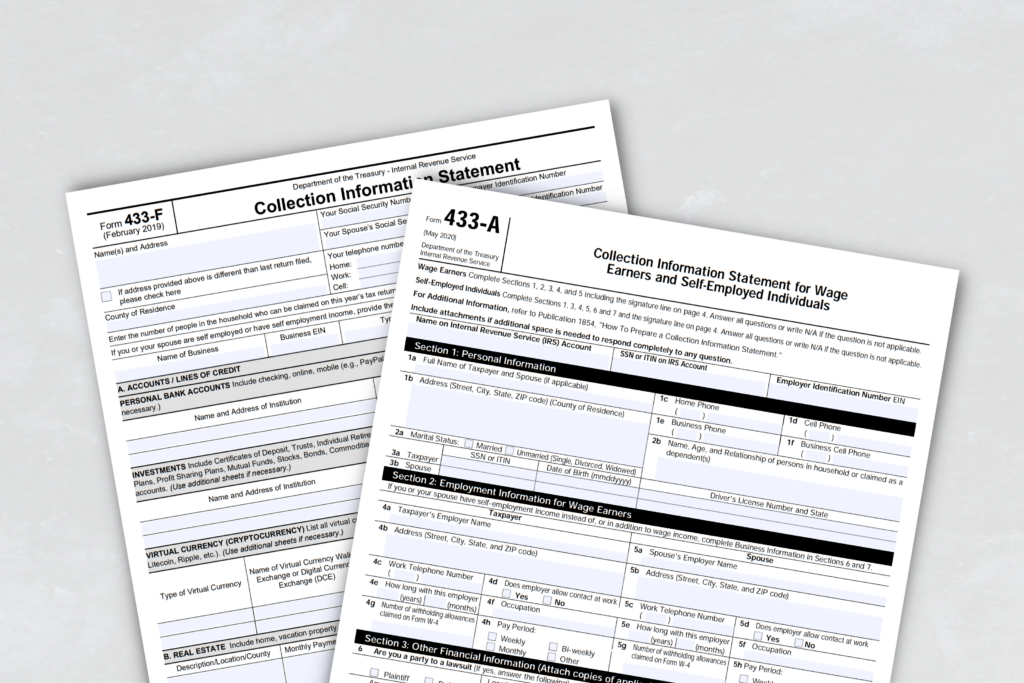

Form 433: How the IRS Assesses Your Ability to Pay Tax Debt

There are circumstances under which the IRS must collect information to determine whether a taxpayer can honor their commitment to a potential payment plan or…

IRS Streamlined Installment Agreement: Understanding Your Payment Options

A tax debt with the IRS can haunt you for years. Failing to settle it can lead to hefty penalties and a stark interest rate…

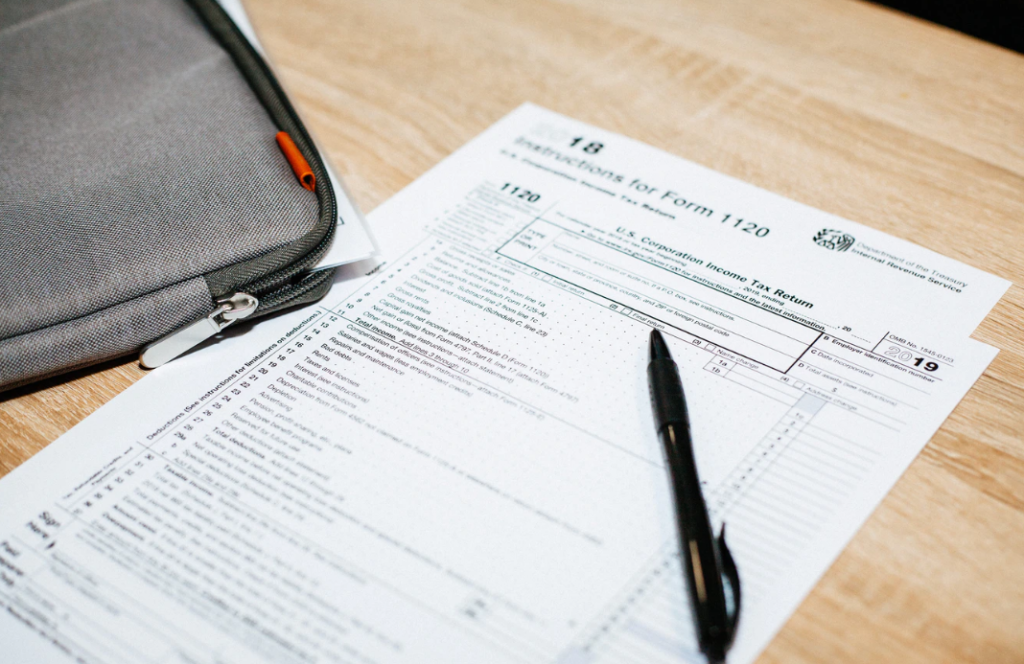

IRS Payment Plans: How to Pay Off Debt Over Time

If you can’t afford to pay your taxes right away, you may be interested in paying off your debt over time. The IRS provides several…

What is the Fresh Start Program with the IRS?

If you owe back taxes, you may be able to qualify for the Fresh Start Program provided by the IRS. This program can help relieve…

How to Setup a Payment Plan with the IRS

If you owe the IRS money but can’t afford to pay the full amount, you may be interested in setting up an IRS installment agreement.…

Subscribe to receive your free tax report